Chapter 5

Storage options

The last link in the CCS value chain is permanent storage of the CO2, and this must be done safely. Today, it seems most relevant to store the CO2 under the seabed, while there are some that also offer storage onshore. This chapter provides an overview of storage facilities within what is considered geographically accessible for waste incineration plants in Norway and focuses on storage sites that will be operational in the period 2028 – 2030.

Limitations

There are many initiatives and plans for storage that will be available throughout the 2030s and up to 2040, but they have not been the focus here as they will only be in place after most of the incineration plants must have found their storage solutions.

It is here looked at when the various storage sites will be ready to receive CO2, what capacity the different ones will have, what requirements they have for quality (where this has been clarified), and price per stored ton of CO2 (where known).

NOTE! In phase 1, most of the planned storage sites are directly linked to specific emission sources and generally have limited capacity to receive from other sources. For most people, it is when they move into phase 2 (typically 2028 – 2030) that the capacity for reception from others increases.

Method

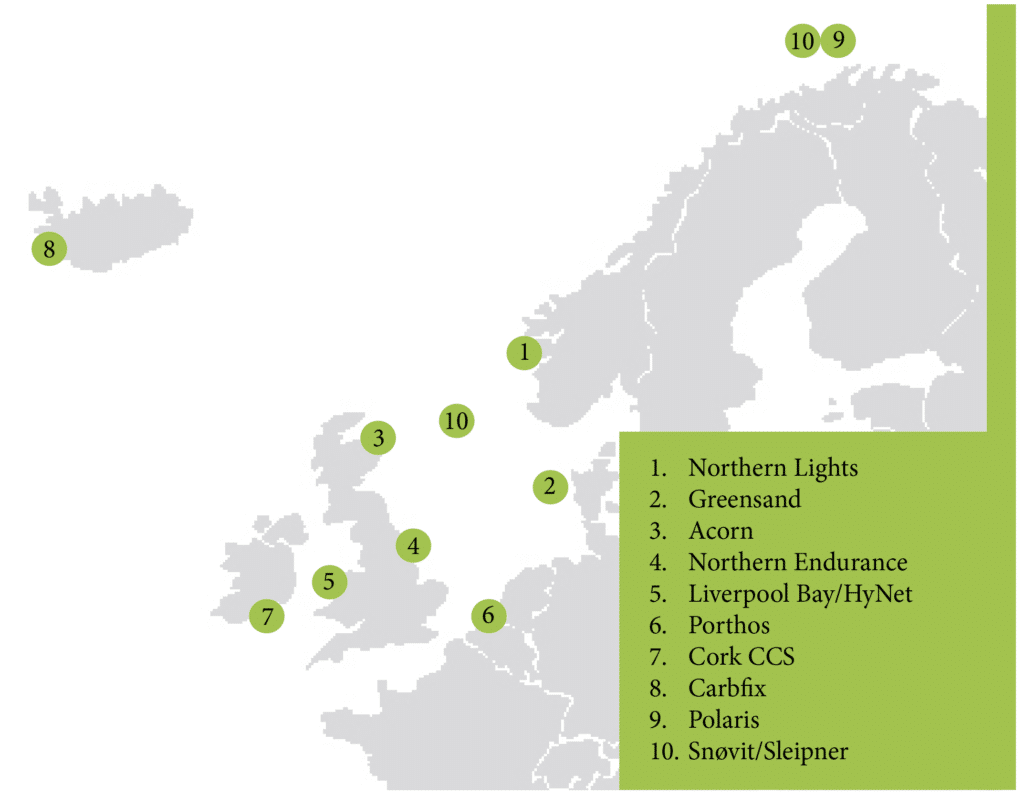

Kartlagte lagringssteder vises i kart på neste side og vedlagt håndboken er disse satt opp i en tabellarisk oversikt over lagringsstedene med tilhørende opplysninger.

The survey has mainly been done through literature searches and the various projects' own websites. Most are currently in the project phase and details for CO2 specification, price, unloading arrangement and logistics solutions are largely unknown.

The willingness to share details without a prior letter of intent or MOU is limited. It would be strategically wise to enter dialogue with relevant storage sites at an early project phase and to secure an agreement on storage before a final decision on the construction of facilities is made.

Areas are constantly evolving

Both the IEA and the Global CCS Institute's analyses and projections point to a mismatch between the need for storage and availability at clear storage sites in the period between 2030 and 2040. Against this background, it would be a clear recommendation to have entered into an agreement with a storage site when implementing a full-scale project.

The overview on the following pages shows a snapshot and the site is constantly evolving.

Tips!

Waste incineration plants are recommended to secure a storage agreement.

If one is planning to establish a capture and storage chain, it is worth noting that the IEA's projections indicate that a mismatch may arise between the need for storage and available capacity beyond a period in the 2030s. It is therefore recommended to have secured a storage agreement before a final investment decision for the construction of a capture chain is made.

About the different storage options

- Northern Lights – Øygarden - Northern Lights is owned by Equinor, Shell and Total with support from the Norwegian state through Longship. Already in 2025, they will be able to offer storage of up to 1.5 million tons of CO2. By 2028, they will be able to offer storage of up to 8 million tons.

Northern Lights has specific requirements for the quality of the CO2 to be stored. This can be found on their website. The price for storage is unknown. - Project Greensand Denmark - Greensand is owned by Wintershell, Maersk drilling and GEUS. Already in 2025, they will be ready to offer storage of 0.5 to 1.5 million tons of CO2. By 2030, they will be able to offer storage of 5 million tons. Greensand has not launched requirements specifications for the CO2 to be stored, but it is assumed that there are less stringent requirements than Northern Lights. https://www.projectgreensand.com/en

- Acorn project Scotland - This project is owned by Storegga, Shell UK, Harbour energy and NSMP. They are ready to receive 0.3 million tons of CO2 for storage in 2025, 1 million tons in 2027 and 5-10 million tons in 2030.

Acorn plans to use existing pipes in Phase 1, the St. Fergus terminal, and to use the St. Peterhead port as the HUB. - Northern Endurance Østby GB Southern North Sea - Northern Endurance is owned by BP, Shell, ENI, Equi- nor, Total and National Grid. They are ready to receive 1.7 million tons in 2026, and 17 million tons in 2030. BP as operator will serve Net Zero Teeside and Zerocarbon Humber (Grimsby).

- Liverpool Bay/HyNet GB - West Coast - This storage is owned by Eni UK, Progressive E, Cadent, CF- Fertillises, Essars and INOVYN. They are ready to receive 4.5 million tons in 2025 and 10 million tons in 2030.

This is planned for the industry cluster – HUB – which will produce low carbon hydrogen. It is unclear whether reception from actors outside the cluster is relevant. - Porthos, Rotterdam, The Netherlands - This storage is owned by EBN, Gasuine and the Port of Rotterdam. It will be ready in 2024 and will be able to receive 2.5 million tons for 15 years.

The storage is primarily intended to cover industry in Rotterdam harbor. The capacity is 37 Mt. - Cork CCS - This storage is in the planning stage. It is Ervia and their regulated gas network in Ireland that are exploring the possibility of CCS development in the Cork area, based at Whitehead and Aghada power stations, with other industry sources as well. Storage will be in the Kinsale gas field, after completion of production, with the possibility of reusing existing gas pipelines for CO2 transport.

- Carbfix - This storage is owned by Carbfix and is currently in the pilot stage. They plan to receive 3 million tons by 2030.

Carbfix stocks from industry and DACCS. Mineralizing ring in basalt structures. Planning receiving hub ship arrival at Coda Terminal. - Polaris North Sea/Barents - This storage is owned by Equinor, Horisont Energ and Vår Energi. They have a storage license for 2 million tons. This storage will only serve the Barents Blue factory. Ammonia production and CO2 storage.

- Snøvit/Sleipner Total - Since 1996, about one million tons of CO2 per year have been captured and stored from the hydrocarbon gas produced on the Sleipner West field in the North Sea.

Others

Aramis (Netherlands) and Errai (Norway) are also important to mention. They do not currently have their locations and associated data ready, but there are concrete plans from the companies and project organizations. There is every reason to believe that these will also be available for storage during the relevant period covered by the study.

Aramis is owned by Total, Shell, EBN and NL Gasuine and plans include a CO2 hub for transport.

Errai is owned by Horizon Energy and Neptune Energy and plans to be ready to receive CO2 from 2026 and then somewhere between 4 and 8 million tons in the period 2026 to 2030. The project includes an onshore terminal for intermediate storage of CO2. The onshore terminal will be capable of receiving CO2 from Norwegian and European customers.

Obs!

A lot is unclear

Most players do not have all the technical details for quality, price and arrangement for delivery detailed as of yet.

It is worth noting that most of the projects in phase 1 are linked to specific emission sources, and that it is not until phase 2, which is in the period 2028 – 2030 for most, that reception from others based on commercial agreements is planned.

See appendix 4: Storage options presented in table.